Those who have followed my blogs know how much emphasis I place on capital allocation; that is, how management manages the excess free cash flow and capital structure of the business. We generally prefer dividends and buybacks since it demonstrates an acknowledgement by the management and the Board of Directors that the cash belongs to shareholders, but there is a special class of companies where the management does an outstanding job of creating value through acquisitions. CCL Industries is a good example of this.

CCL Industries is one of those companies whose products everyone uses, but only a few could name. CCL’s traditional core business is printing stickers, labels and sleeves for consumer goods such as shampoo, beer, and over-the-counter drugs. You may recognize some of the following CCL products (focus on the sticker/label):

CCL’s clients include virtually all major consumer goods companies such as Procter & Gamble, Unilever, L’Oreal, Heineken, McDonald’s, Intel, and Bayer. With over 150 plants in 35 countries, CCL is the only label maker with enough scale and technology to serve these multinational giants on a global basis, and opens plants close to its clients’ factories around the world.

CCL’s Geoffrey Martin has done a terrific job of capital allocation since becoming CEO of CCL in 2008. Largely through acquisition, CCL has increased its revenues and operating income by 3x and 4x respectively with a minimal increase in shares outstanding and while maintaining net leverage below 2x EBITDA. Most importantly, CCL is highly disciplined in the price it pays when acquiring companies. The returns are generated as a result of paying cheap and opportunistic prices, as opposed to extracting synergies. From the time Geoffrey Martin became CEO till today, CCL has invested $2.8b (CAD) in 30 acquisitions at an average price of 5.3x EBITDA. Of this, $2.1 billion paid for three major acquisitions, and in each of these cases, CCL was able to pay a cheap price to a distressed and motivated seller.

Avery

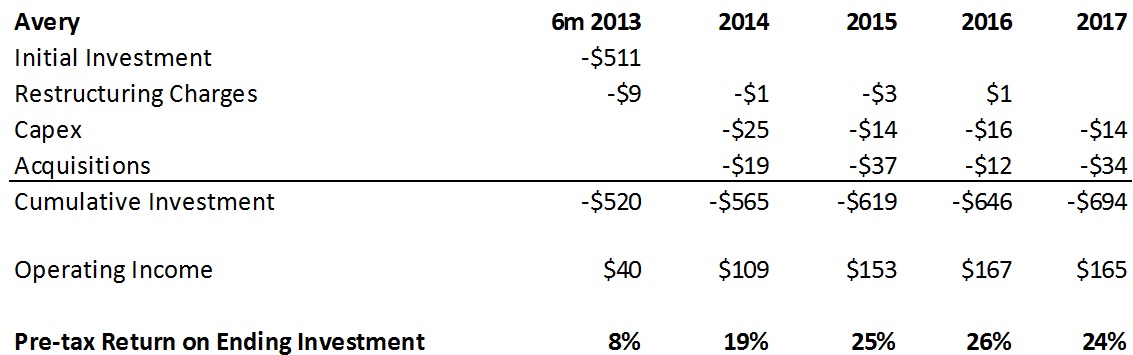

In 2013, CCL acquired the “Office & Consumer Products and Designed & Engineered Solutions” divisions of global tape-maker Avery Dennison for $511 million. At the time, this was the largest acquisition in CCL’s history, and CCL called the acquired businesses “”the Avery segment” upon completion of the acquisition. This business makes things like Avery ring binders, envelope labels, and various other office supplies.

Avery was, and still is, a business in structural decline, and was also facing some competitive pressure from 3M, so Avery Dennison eventually agreed to sell the Office Products division to 3M for $550 million USD. The deal was blocked by the US Government on antitrust concerns (3M would have had an 80% market share in sticky-notes), and Avery Dennison was so keen to sell the business that it ended up selling the Office Products Division to CCL for a lower price ($486 million USD) while adding in the Designed and Engineered Solutions division as a sweetener.

Since the acquisition, CCL has already earned back its entire purchase price and is currently earning around a 25% annual pre-tax return on its investments in Avery.

Checkpoint Systems & Innovia

In 2016, CCL announced the acquisition of Checkpoint Systems. You probably have seen Checkpoint’s security gates at a retail store.

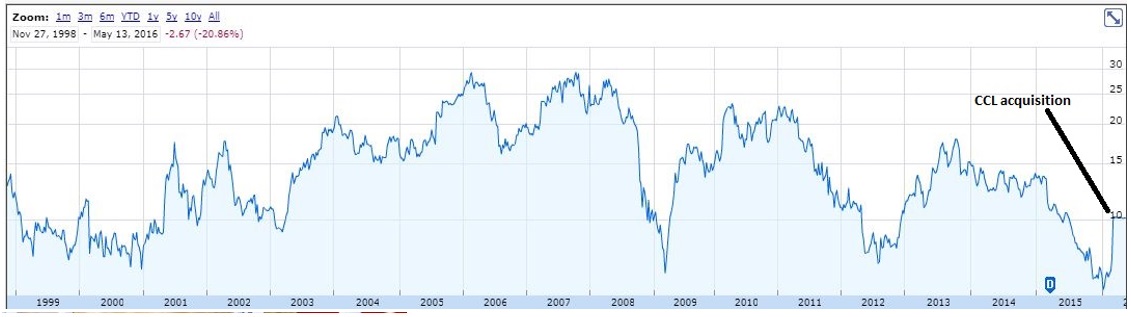

At the time of the acquisition, Checkpoint’s shares were at multi-decade lows and there were several activist investors who were preparing for a proxy fight to replace the Board of Directors and management team.

Rather than face the proxy fight, the management decided to sell the business and earn a large severance payment (the CEO earned nearly $4 million of severance). In a letter opposing the sale, Checkpoint shareholder North Star Partners wrote:

“It appears that the Board is leaving no stone unturned in its attempts to avoid the indignity of losing its hand-picked members. Why else would it agree to sell the Company at a price that is 25% below where the stock traded just a year ago?”

As with Avery, the Checkpoint acquisition demonstrates CCL’s acute skill in snapping up assets from a motivated seller and following the acquisition, CCL has made several improvements to the business and is already earning a 17% pre-tax return on investment by the second year:

Finally, CCL acquired Innovia one year ago in February 2017. Innovia is the world’s largest printer of polymer banknotes and a major supplier of films and coatings for labels. Virtually all of the world’s polymer banknotes such as the Canadian $5 bill are printed by Innovia.

The previous owner of Innovia was a group of private equity owners that was going through some challenges. With CCL acquiring Innovia for a fairly low multiple (7.3x EBITDA), we expect this investment to follow the return profile of the Avery and Checkpoint Systems acquisitions as well.

What’s next for CCL?

With this strong track record of capital allocation, we believe CCL Industries is one of those rare companies that we can trust to wisely deploy capital in the long-run. The Board of Directors is certainly incentivized to do so, with Chairman Donald Lang’s family still owning 17% of the outstanding shares.

CCL’s share price has been relatively flat over 2017 as the management worked to reduce the leverage from the Innovia acquisition, while staying on the sidelines in a pricey acquisition environment. Today, CCL’s leverage is below 2x EBITDA and the management has indicated there is a healthy pipeline of both large and small acquisitions. CCL shares are currently trading at 21x consensus earnings for 2018, which we view as a reasonable price given the strong track record of compounding capital. CCL currently pays out around 15% to 20% of earnings as dividends. If CCL can continue to invest the remaining 80% of earnings at “just” a 20% return (CCL has averaged more than this over the last 4 years), earnings will double in roughly 5 years and as shareholders, we should expect a decent return no matter how the stock fluctuates day to day.

One final observation is that just because a stock has risen is not a good reason to buy or not buy a stock. When we started buying shares of CCL in 2017, there were more than a few questions about whether we had missed the rally with CCL shares trading at an all-time high. Only by digging deep into the fundamentals of the business and the capital allocation decisions of the management can one tell whether a business is a good deal at any particular price.

Ernest Wong

Clients of Baskin Wealth Management are shareholders of CCL Industries