(This blog post is based on concepts from Howard Marks’s excellent book “The Most Important Thing, Common Sense for the Uncommon Investor”. I highly recommend it)

People choose asset management firms, including Baskin Wealth Management, to manage their money for many reasons, but ultimately, the main reason is for superior investment performance. When people think about superior investment performance, they usually interpret this to mean “beating the market” over some arbitrary time period. For this blog post, I want to explore this topic in more detail.

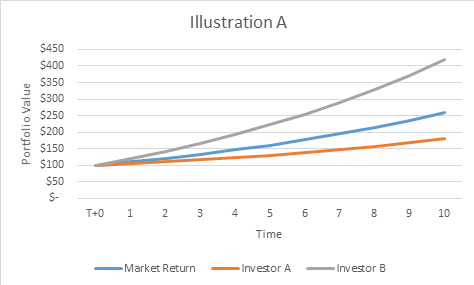

To fully evaluate an investor’s skill, you need to evaluate the performance throughout a full cycle. Comparing performance simply when the market rises or falls would paint a misleading picture. To illustrate what I mean, observe the below graph:

The market has returned 10% for 10 straight periods. Investor A has severely lagged the market, while Investor B has massively outperformed the market. Based purely on this graph, you would conclude that Investor B is a terrific investor, while Investor A lack investment skill. However, suppose now that the market crashes, and falls by 20% per year for the next 4 periods.

This is the true test of Investor A and Investor B’s investment skill. In Illustration B, Investor A falls by around half the rate of the market when the market falls, while Investor B falls by roughly twice the rate of the market. As a result, zero investment skill has been demonstrated by either investor because the neither did any better than the market in the end. The divergence in performance was simply due to a difference in risk-taking. In Illustration C however, Investor A’s portfolio soars when the market falls, perhaps due to large short bets. Investor B portfolio falls, but at a lesser rate than the market. Both investors here demonstrate investment skill, but Investor A is clearly the superior investor despite the lackluster performance for the first 10 periods.

The point of the above demonstration is that you simply cannot judge an investor’s performance except over a full investment cycle, since any investor can look like a genius in good times simply by taking on more risk (although the definition of “risk” is beyond the scope of this blog post). There is no way of telling whether the investor was being skillful in applying leverage (or being conservative) at the right time, or is just a “lucky idiot”. Only when the market moves in the other direction, can it be determined which of the above it was.

A second, but less obvious observation is the difficulty of timing the market. There are no shortage of opinions from market commentators on which way the stock market will go in the near term. However, if someone was truly able to predict the direction of the market, even just somewhat accurately, there would be no need to pick stocks. You can simply buy the market when you think it will go up, and sell when you think it will go down, this will severely outperform the market over the long run. The fact that there are virtually no investors out there that have done this successfully over an extended period of time demonstrates the impossibility of predicting the market in the short-term. This is why we ignore the level of the market when making investments, and simply focus on picking good companies trading at reasonable valuations.

Ernest Wong

January 25, 2018