Analyst Ernest Wong debuts on our blog page with a story about Whistler.

Warren Buffett once said, “The single most important decision in evaluating a business is pricing power”. We agree. Here is why we think it is so important.

It means that your customers are not solely motivated to purchase your product or service because of price. The corollary to this is that there is something special about your product that attracts people.

Pricing power makes it easier for the company to control its own destiny since the factors for success are not solely related to price. It also provides some insulation from cost inflation. Even the most skilled oil executives cannot maintain margins if oil prices fall.

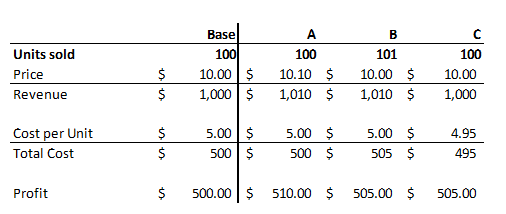

Pricing power is the easiest way for companies to increase profits. Suppose a company has the choice to increase profits either through a 1% increase in price (A), selling 1% more goods (B), or reducing costs by 1% (C). In a vacuum, option A would result in the most profit. Mathematically, Option A would always result in higher profits than either options B and C.

However, there are a couple of caveats about pricing power in investment evaluation:

Having pricing power does not mean that a company has unlimited pricing power. You may pay more for Godiva chocolates than other brands, but very few would pay $100 for a piece of Godiva.

Having a consumer-focused or “nice-looking” products does not necessarily equate to pricing power. For example, automobile manufacturers try to distinguish their vehicles with pleasant or sleek designs, but most car makers have very little pricing power.

From an investment perspective, we like to find companies with untapped pricing power, meaning they still have the ability to raise prices in the future. What matters in investing is the future, and it won’t help our investment performance if a company was once able to raise prices, but is no longer able to do so.

A company with untapped pricing power that we own in our portfolio is Whistler Blackcomb (Whistler). Whistler manages and owns 75% of the Whistler Blackcomb ski resort in British Colombia. Revenue is generated by selling lift tickets, ski lessons, and food/souvenirs. The resort is located around Whistler Village, which is 2 hours north from Vancouver. Whistler Blackcomb is the largest (in terms of skiing area) and most-visited ski area in North America and has been named the best overall ski resort in North America by SKI Magazine’s reader poll in 3 out of the last 4 years.

In general, ski areas have very little pricing power, as most ski areas in a particular region provide a similar skiing experience. Locals in the area looking for a fun day trip are most likely to go to the cheapest ski hill. Whistler is different. Its prestige and reputation attract guests from around the world, and about half of visitors are non-locals who fly in. These “destination guests” are willing to pay for the premium Whistler experience which includes not just world class skiing, but the luxury spas, fine dining, children’s programs and other amenities in the Village. Whistler does not directly own the hotels and other stores in Whistler Village, but works together with them in planning to draw guests to visit the area.

Whistler’s pricing strategy segments users into locals and non-locals. Locals who live in British Columbia, Washington State, or Oregon can apply for a discount card which allows them to visit Whistler at locally competitive prices. Destination guests pay the “regular price”, which they are willing to do. Although the average price amount paid for a Whistler ticket as of 2016 is $60.39, in reality, locals paid less and destination visitors paid more. Historically, Whistler has been able to raise prices without a drop in visitors. Lift ticket prices are up about 33% in the last six years, an impressive display of pricing power.

There is still a lot of room for Whistler to raise prices. Whistler’s largest competitor is Vail Resorts (NYSE:MTN) in Colorado. It charged an average ticket price of $71.40 USD for the 2015-2016 ski season ($91 on a CAD equivalent basis), about 50% more than Whistler. Vail generated $166 of revenue per skier visit (i.e. including food and merchandise) compared to about $120 for Whistler. Even adjusting for the difference in higher-paying foreign visitors (60% of Vail’s guests are destination visits) and assuming a higher CAD exchange rate, this is still a pretty large gap. There does not appear to be any fundamental reason why this is the case, as the experiences are pretty similar at Vail and Whistler.

Going forward, management at Whistler plans to take advantage of this untapped pricing power, and has already raised day ticket prices for the 2016-2017 ski season by 7%. Whistler is working on a new development plan to drive increased visits in the summer months, a strategy that has also been completed successfully by Vail.

As with all companies, Whistler faces some challenges. It has a complex capital structure that favors the minority interests, and Whistler is required to consult and pay royalties to the First Nations and the B.C. government for any expansion or changes that they want to make. Labor is also expensive, as housing must be provided for employees. However, as long as Whistler can continue to create a premium experience, the pricing power will still exist and earnings (and the share price) should march upwards along with price increases. Whistler currently provides a 7% free cash flow yield to shareholders, with half of this paid in dividends. We think this is a high quality company, with a long runway of growth, trading at a reasonable price.

Clients of Baskin Wealth Management are shareholders of Whistler.