Productivity, Growth and Investing

For reasons known only to itself, the Canada Revenue Agency (CRA) has suspended online access to my account, and tells me I need to speak to someone. Easier said than done. The last three times I have called the number, I have been told that the wait time would exceed 90 minutes. I did not wait. I have things to do. I am trying to be productive.

Now it would be one thing if we imagined that a lean and mean federal government was doing its best to carry on short-handed, but in fact, in 2022 the CRA added 16,000 employees. The staff now comes in at around 55,000. You would think some of them would know how to answer the phone. The CRA staff is now part of a Federal government work-force (or perhaps more accurately employee complement) of about 340,000, up from around 250,000 eight years ago. That’s growth of 36% or 4% per year, about three times faster than the population has grown.

Lately we have been reading a lot about productivity, and how little of it we have in Canada. We are told that we are falling behind other rich countries, more and more each year. Our per capita income is now not just lower, but considerably lower, than our peers. If this keeps on we will soon not be their peers at all; we will slowly and meekly sink into the second tier of wealthy nations. What’s going on?

Productivity is a measure of how much output we get per unit of input. In simplistic terms, if two workers are paid the same wage and one produces twenty widgets per hour, and the other produces twenty-five, the second is obviously more productive. If worker one is in Canada and worker two is in the U.S., we have a serious problem. How can productivity be improved? Perhaps the Canadian worker would benefit from better equipment: a capital investment in plant and machinery can boost output. Maybe better management would provide incentives that would enhance output. Perhaps a change in the working environment (a nice building, more appropriate regulation, lower taxes) would cause the less productive worker to be as productive as the worker to the south.

Sadly, Canadian business investment per worker is about half of what it is in the U.S. and is substantially lower than other OECD countries. Even before interest rates started to rise; in fact, even when investment capital was effectively free, (being available at interest rates that were lower than inflation), Canadian business owners did not invest in the tools that have increased productivity elsewhere.

Even more sadly, rather than helping to reverse this trend, our Federal government is not helping. Take for example the current dock workers strike in British Columbia. The 7,400 striking workers are costing Canada hundreds of millions in lost exports. The strikers are worried about automation – in other words, things that would make them more productive. History has shown that industrial progress can be slowed, but not stopped. The BC workers might succeed in delaying automation, but the cost to Canada could be huge if shippers change their destinations to Seattle or Long Beach, where the ships will be unloaded faster and less expensively using state of the art technology. A government that actually cared about productivity would have long ago imposed back to work legislation, and perhaps, provided incentives for the ports to modernize. Instead, we get crazy ideas like the scheme to build a new deep water port in Cape Breton, far from railheads, and in spite of under-utilized capacity in Halifax, Saint John and Montreal.

Another obvious example of how our government has impeded productivity and squandered opportunity is our permitting process for exports of liquified natural gas (LNG). Canada could easily be a world leader in this industry, which largely replaces carbon-heavy coal. We could have hundreds or thousands of highly productive jobs. Instead, a timorous Federal government has stalled project after project with years and even decades of regulatory and environmental reviews. Negotiations with a myriad of First Nations only exacerbate the problem. By 2027, Canada might be, with some luck, exporting 19 million tons per year of LNG. By that time, the U.S. will have added about 190 million tons per year of capacity, or ten times as much, in spite of Canada having lower input costs, and being closer to prime end-user markets in Asia. Is it any wonder that we have low investment in this industry and the critical infrastructure that supports it?

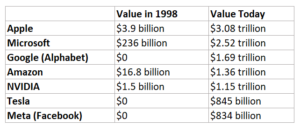

Things are different in the U.S. Much has been made of the rise to prominence of the “Magnificent Seven” – the technology companies that now dominate the market. Take a look at how their market capitalization has grown over the last 25 years:

The wealth created by just these seven companies over 25 years is a staggering $11 trillion. By contrast, the current value of the entire TSX index is about US$ 2.4 trillion. Our largest technology company, Shopify, is today valued at US$84 billion, or about 1/10th the value of Meta (Facebook) and less than 3% of the value of Apple.

While there are many reasons why Canada has been left in the dust in the rise to riches of the mega-tech companies here are three:

- Low investment in research and development. The numbers speak for themselves. Canada spends about 4% of what is spent in the U.S., and less than what is spent in Brazil.

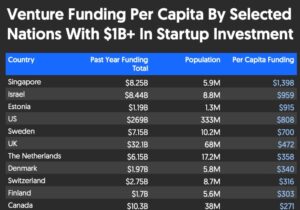

- Lack of venture investing. Almost all big technology companies were recipients of seed capital from venture firms. Once again, this is an area where Canada trails its peers. The U.S. venture capital industry is 25 times larger than Canada’s. Any smart entrepreneur will look for capital there.

- High Taxes. At over 53%, Canada has a very high income tax, and a very high tax on capital gains at 26.5%. This is 30% higher than the top rate in the U.S. for long term gains. Nobody wants to build a great company and then give so much of the value to the government in taxes. We have created a disincentive for company builders and entrepreneurs.

The recent attention to the productivity issue in Canada has caused a number of our clients to ask me if it is still worthwhile to invest in Canada. Despite its flaws, Canada has a lot of good things going for it. We have a stable democratic government, strong healthcare for all, and affordable high quality educational institutions. Our strong social programs attract thousands of trained and high value immigrants every year. Canada also has some of the largest deposits of natural resources in the world, not just oil and gas, but also lumber, fertilizer, and more recently, lithium.

Regardless of the country or the sector we are analyzing, we invest in companies one by one, not in the entire stock market. Despite not having anything on the scale of the Magnificent Seven, Canada has some remarkable companies that do an efficient job of deploying capital. In every country and every economy, wonderful companies are scarce on the ground. Our job is to find the few outstanding companies and deploy our client’s capital in buying a small part of them. Will Canada develop any companies that are the equivalent of the Magnificent Seven? The odds are against us. For this reason, much of our equity investing is concentrated in American companies. As of today, about 54% of our equity holdings are in U.S., companies compared to 41% in Canada. Moreover, much of our Canadian investing is in lower growth, high dividend paying companies, due to the favourable treatment on Canadian source dividends.

Willie Sutton was one of the most persistent American bank robbers. Over his forty year crime career that started 100 years ago, it is estimated that he stole over $2 million. He spent much of his adult life in prison. When asked why he robbed banks, he famously answered “Because that’s where the money is”. When investing, our job is to go where the money is. Right now, that’s the U.S. where productivity is high and growing.

Chairman

David Baskin

Media Appearances

David Baskin on BNN’s Market Call – July 14th, 2023

Barry Schwartz on BNN’s The Street: Stocks tend to do the best when inflation falls – July 21, 2023

Blog

Understanding The Baskin Fixed Income Pool – David Baskin – July 5th, 2023

Long Term Investing Podcast with Barry Schwartz

Interesting Reads