Last November, shares of Restaurant Brands International, the parent company of Tim Hortons, Burger King, and Popeyes, shot up on the announcement that Patrick Doyle would be the incoming Executive Chairman. The market’s enthusiasm is well founded: Doyle is best known for leading the turnaround of Domino’s Pizza as CEO from 2010 to 2018 with Domino’s Pizza being the #1 performing stock in the S&P 500 during that time.

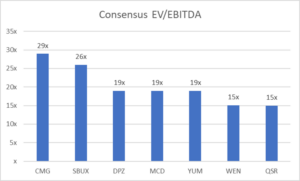

Despite its portfolio of strong brands, Restaurant Brands shares have continued to trade at a large discount to other fast-food peers due to the ongoing underperformance of Tim Hortons and Burger King, which make up about 80% of its systemwide sales.

The issues at both brands are very well-known: a weakening brand perception due to poor product innovation, lack of investment in technology and a hostile relationship with franchisees. Under 3G’s leadership, Tim Hortons had a confusing product strategy and cut costs by underinvesting in technology and marketing, leading to open revolt from franchisees at times. Similarly, Burger King is in the midst of its own turnaround, as a lack of digital investment and poor marketing and product execution led to Wendy’s overtaking Burger King as the 2nd largest burger chain in 2021.

However, the poor state of Tim Hortons and Burger King is exactly the same situation that Domino’s Pizza was in when Doyle became CEO. In 2009, Domino’s brand was so poor that people were less likely to eat something if they learned that it came from Domino’s. Under Doyle’s leadership, Domino’s entirely revamped the menu and the quality of the pizza, invested heavily in digital such as the mobile app and the Pizza Tracker, increased accountability of franchisees, and importantly, made franchisee profitability as the cornerstone of Domino’s strategy. All new products, investments, or promotional offers were evaluated on their potential profitability to franchisees. Because franchisors typically earn royalties as a percentage of gross sales, there can be perverse incentives for the management to drive unprofitable sales at the expense of franchisees by aggressive discounting or adding new “limited-time offer” products. Domino’s focus on franchisee profitability led to industry-leading returns for franchisees, and ultimately a more resilient and faster-growing store base.

This is the key cultural change that needs to be implemented by Doyle. As the Executive Chair rather than CEO, his key responsibility will be determining the overall strategic direction of the company, rather than driving the daily execution. However, this will be good enough. There is a clear mandate from the top that franchisee profitability will be the guiding principle for all strategic directions. Some specific changes that are already being implemented across Restaurant Brands’ banners include:

- A revamped menu and national offer that focuses on core, permanent product platforms such as breakfast sandwiches and iced coffee at Tim Hortons, and Whoppers at Burger King.

- Aggressive investments into digital ordering and marketing analytics capabilities including the mobile apps, loyalty programs, and digital menu boards.

- Increased experimentation around store formats and in-store operating procedures including drive-thrus.

- Increased accountability/training for underperforming franchisees including the implementation of the A/B/F rating system, where only “A” or “B” rated franchisees will be allowed to open or acquire new stores.

These are all the right steps for Restaurant Brands to restore franchisee profitability and ultimately drive store growth.

A parallel for Restaurant Brands can be found in the railway industry with CP Rail. In 2012, hedge fund manager Bill Ackman (who is also currently a large shareholder in Restaurant Brands), convinced legendary railroad executive E. Hunter Harrison to turn around the underperforming CP Rail with a very generous stock options grant. By the time he stepped down in 2017, CP Rail’s stock price had gone from $16 to $40, more than doubling in under 5 years.

We think that Patrick Doyle’s appointment as Executive Chair is Restaurant Brands’ Hunter Harrison moment and expect to see material improvements in the business over next few years.