Designating a beneficiary on your registered accounts is one of the most important decisions in estate planning. By designating a beneficiary, you inform the financial institution of your plans for your estate after your death. While it is a simple act requiring little in the way of paperwork, it can do a great deal of heavy lifting in establishing your wishes for your estate and ensuring your assets are distributed according to your wishes when you die.

Designating a beneficiary confers multiple benefits. First, if you choose to designate your spouse or common-law partner as beneficiary, your spouse is able to receive the entire amount of any registered accounts – RRSPs, RRIFs, TFSAs, LIRAs, etc. – with no immediate tax consequences, and they are also able to maintain the assets’ tax-sheltered status. This is a major benefit not available if someone other than the spouse (or some dependent children or grandchildren) is chosen as beneficiary. Note that on a RRIF and TFSA, the spouse must be designated as a “successor annuitant” (for RRIF) or “successor holder” (for TFSA) – this requires no additional cost or effort. This can also typically be done after the account owner’s death, if necessary.

Second, designating beneficiaries allows registered accounts to pass outside of probate. When a person dies, their Will and wishes must be approved by a probate court to ensure that certain legal requirements are satisfied, as well as to ensure that the Will itself is in good order. By designating a beneficiary on registered accounts, those accounts are not deemed part of the deceased’s estate. This means that there is no probate tax (called Estate Administration Tax in Ontario) applied to those assets; in Ontario this can mean savings of up to 1.5% of the value of the assets. As well, the assets can typically be distributed more quickly than assets which require probate – generally in a period of a few months, as opposed to probated assets which can take well over a year.

Another benefit of beneficiary designations is that while in most cases the tax benefits are conferred on a spouse or common-law partner, they can also be conferred onto a financially dependent minor child, or a financially dependent child or grandchild of any age with a disability.

It is also important to ensure that your beneficiary designations align with your wishes as laid out in your Will. If your account beneficiaries differ from the beneficiary of your estate, the probate courts could be forced to make a decision on your estate’s behalf as to your wishes. They will also consider certain estate requirements such as matrimonial property (ensuring your spouse is left with enough resources).

By designating a beneficiary on your registered accounts, you can accomplish much of your estate planning needs in one fell swoop. Not only do you establish your wishes for your assets after your death, you also allow your surviving beneficiaries to benefit from significant tax savings at the same time. We are happy to ensure the beneficiaries on your registered accounts align with your wishes.

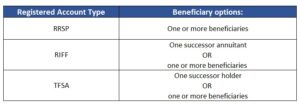

Here is a reference chart showing options for beneficiaries: