There are lots of investment styles, and it is certainly the case that no one way of doing it will be best for everyone all the time. Some people are really traders, not investors, and seldom hold a position for more than a day (some not even overnight). Some people like following momentum, and will ride a hot name until it seems to fizzle out. We like the style usually called “buy and hold”. It is based on using fundamental research to buy stocks that we think we will want to hold for a long time. Once, when asked what his ideal holding period was for a stock, Warren Buffett answered “forever”.

Eddy Elfenbein, who runs a site and newsletter called Crossing Wall Street creates a stock buy list of twenty-five names every new year, and then holds those stocks for the entire year. I am sure he agonizes over every name on the list, knowing that he will be looking at those stocks each day for 12 whole months. (By the way, he does a terrific job and his newsletter is well worth reading.) He is a good example of a “buy and hold” investor.

But imagine if you had to hold every stock you bought for five years. No mulligans, no do-overs, no substitutions. You buy it, you own it for sixty months. What kind of portfolio would you build? This question occurred to me because, while doing my year-end accounting, I found my own family stock portfolio from Dec. 31, 2016, exactly five years ago. These were the ten biggest positions on that date, in descending order of size:

Bank of Nova Scotia – Canada’s 4th largest and most international bank.

Apple – Everyone knows Apple, at the moment the most valuable company in the world.

Brookfield Asset Management – Canada’s 4th most valuable company, an infrastructure giant.

TD Bank – Canada’s 2nd largest bank.

BCE Inc. – Everyone knows BCE.

Alphabet – The parent company of Google, and one of the largest technology companies.

Fortis Inc. – A large utility company famous for 50 years of consecutive dividend increases.

Keyera Corp. – A mid-stream energy company mostly involved in natural gas processing.

Morguard Corporation – A Toronto-based real estate holding company.

Cineplex Entertainment – Canada’s largest movie exhibitor.

On its face this is a pretty diversified portfolio. It has finance, technology, telecom, utilities, real estate, energy and consumer products. It has six giant companies, and four smaller ones. It has Canadian names and US names, and it has nine dividend payers out of ten stocks. Would I have picked this portfolio if I knew I would have to live with it for five years? Probably not. I would likely have swapped in some larger, more stable companies for some of the smaller names. But anyway, for better or worse that’s what I actually owned on that date, so let’s see how it would have worked had I held everything up to Dec. 31, 2021. (By the way, I currently own eight of the ten names, but some are no longer among my largest holdings).

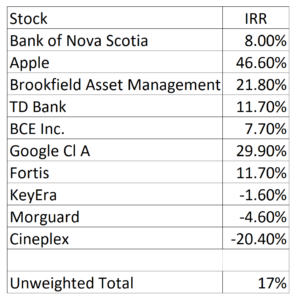

Here is the actual total return for each stock (including dividends). The IRR or Internal Rate of Return shows the compounded increase in value over the five year period from Dec. 31, 2016 to Dec. 31, 2021. IRR assumes that dividends are reinvested upon receipt and therefore contribute to the compounding effect. The only company on the list that did not pay a dividend over the five year period is Alphabet.

A compounded return of 17% over five years is very good, even in the context of the great market gains of the last few years. You can see that two huge winners drove the return for the entire portfolio. Apple did an unreal 46.6% IRR on the way to becoming the world’s most valuable company. Alphabet added a lot, just shy of 30%. Brookfield was also far from shabby, contributing 21.8% per year for the period.

The other stocks? Four of them were okay. The two banks, BCE and Fortis were solid. Nobody complains about a stock that does 8% to 12% per year over a long period of time. These names got almost half of their return from dividends and the other half from the increase in the share price. And then we have the laggards. KeyEra suffered from the drop in energy prices and the market’s loss of interest in the sector. Only the high dividend kept the return near break-even. Morguard spent half a decade ignoring its shareholders. It did not increase its dividend, took no steps to enhance shareholder value and generally behaved as if it were a private company.

Cineplex stands out as the only substantial loser, and it is, of course, the victim not only of a generational change in consumer behaviour from movie theatre attendance to online streaming, but also a “black swan” event. No investor expects a global pandemic, in this case, one that shut all movie theatres for the better part of two years. Cineplex entered into a deal to sell most of its assets to a large British movie chain; the deal did not close and is the subject of ongoing litigation. With a huge drop in revenue, Cineplex was forced to cut its dividend to zero and its share price dropped like a rock.

What can we learn from this exercise in looking backwards? I think there are some good lessons in portfolio construction:

- In any portfolio, a small number of companies will end up doing the heavy lifting. You don’t, of course, know which ones, but it is good to have a few potentially high growth names.

- Solid, high quality dividend payers earn their keep by stabilizing the portfolio over time and providing steady, unspectacular returns, year in and year out.

- Commodity related companies can make your year or break your heart, and there is nothing you or the company can do about it.

- Nobody is immune from a black swan event. Diversification, however, provides some shelter from the storm.

At Baskin Wealth Management we think long and hard before we add a name to our “buy” list. We only add a few stocks each year, usually around five or six. We don’t own every stock for five years, but we have owned lots of them for much longer. Further, when we construct portfolios, we are always trying to create a diverse and durable mix that will do well whatever the market happens to throw at us, black swan events and all.

Finding good stocks to buy at good prices is hard work. If we act as though we will have to own each new purchase for the next five years, our focus will be not on the next quarter or the next year, but on the company’s real potential to add value to the portfolio for a substantial period. This leads us to buy the high quality stocks that will reward our clients over time. This, for us, is what investing is all about.