An interesting phenomenon about the recent bear market is that it is not uniform. The S&P 500 is down 8% since January 1, 2022, while the technology-heavy NASDAQ Composite is down 12.5% and funds focused on disruptive companies such as the ARK Innovation ETF are down well over 20%. Many “COVID winners” such as Netflix and Peloton that experienced a surge in demand due to global lockdowns have now underperformed the S&P 500 in the two years since the COVID crisis began while others such as Zoom, Shopify, and Roblox are down over 60% from their all-time highs. This is a puzzling result since there is little doubt that these companies had benefitted from COVID and are larger today than they would otherwise be.

As often happens, the narrative follows the share price and the story about the secular pull-forward of digital adoption, e-commerce and work-from-home trends is now replaced by one of slowing growth, poor management, and aggressive competition. It is in these times where an investor’s conviction is tested: do you really believe the long-term growth opportunity of the business, or were you simply chasing the stock price?

Looking past macroeconomic concerns such as inflation and Ukraine, my general view is that the current slowdown in financial results for many of the COVID winners is largely cyclical. A fairly consistent theme among many COVID winners that have sold off is a sharp decline in marketing efficiency in acquiring new customers and a corresponding decline in growth expectations for 2022. This should have been a predictable result given the elevated profitability and growth of these companies during the COVID pandemic.

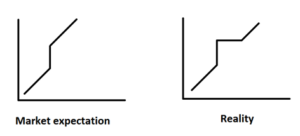

Just as the stock market did, executives of these companies got caught up in the strong financial performance resulting from COVID and confused a cyclical, temporary growth in demand with a structural, permanent pull-forward in growth. During the pandemic, lockdowns led to strong demand for products that enabled you to exercise, communicate with each other, and work from home. Companies that provided these products experienced a windfall in profits as demand soared without any necessary increase in marketing costs. Executives held Investor Days touting their strong engagement metrics, secular growth opportunity and initiatives to disrupt new markets, and announced lofty long-term growth and margin targets which the stock market rewarded with high valuations. Investors also told each other exciting stories about unlimited TAMs, the metaverse, and web3.

Then society started to reopen from COVID, and growth slowed. At first, companies argued the slowdown is temporary due to controllable factors, but eventually admitted that the previous margins and growth targets are unsustainable, either requiring additional marketing spend to continue growth or simply choosing to refocus on profitability through cost cuts.

With hindsight, this was a predictable outcome. It was unreasonable to expect that growth rates would stay elevated especially from a higher base: anyone who didn’t buy a Peloton bike or sign up for Netflix or use DoorDash for food delivery while stuck at home for over a year is not likely to do so once they were allowed to return to gyms, restaurants, and movie theaters. To put this another way, revenues were simply pulled forward without a meaningful change in the long-term growth rate.

As an example, before COVID, PayPal’s management expected to grow revenues at 17-18% over the medium-term, but then raised its target in Feb 2021 after COVID began to 20%. Once PayPal reduced its revenue growth expectation down to 15% for 2022 (still a very respectable rate) given the headwinds from reopening of physical shopping and reduced stimulus payments, the stock market reacted negatively but an investor should have realized that it was highly unlikely for PayPal’s growth to accelerate.

There are several lessons for investors:

First, the investor should take care not to over-extrapolate recent trends especially without considering the special circumstances contributing to performance In 2021, many companies had fancy charts showing improving margins and cohort analysis showing increasing growth and engagement which investors used as evidence regarding the management ability and quality of the business. In hindsight, of course metrics would look terrific in the best of times: every oil company also reports record profits when oil prices are high.

Second, understanding the market’s expectation for a company is as, or even more important than the raw fundamentals and unit economics. When investors are excitedly talking about how a company will successfully disrupt large new markets, it pays to be skeptical even if you are bullish on the long-term future of the company. As Warren Buffett famously puts it, “be fearful when others are greedy”.

The good news for many of these companies is that the long-term growth opportunity appears mostly intact. Trends such as digital payments, e-commerce, streaming, and online communications are still secular trends given their convenience and affordability relative to legacy competition. Growth should re-accelerate back to a more normalized growth rate once the COVID overhang fades away, with a more focused management team and higher profitability. Narratives have also calmed down, with investors and analysts generally taking a more rationale view regarding the growth opportunities. To be sure, there will be mediocre companies with structurally poor economics that will fade away, and it is impossible to know when the market will reward growth again, but we think there are attractive buying opportunities among the former COVID winners given current valuations.