CA–NA–DA! NOW WE ARE 40 MILLION!

The news that the population of Canada hit 40 million in June arrived just before Canada Day. Those of us old enough to remember the Centennial celebrations in 1967 probably immediately flashed back to Bobby Gimby’s Canada Song (here is a link for those who desire a quick trip down memory lane. We assume no liability for ear-worm disorders. https://www.youtube.com/watch?v=Uj4LZB5oarA) and its proclamation “Now we are 20 million”.

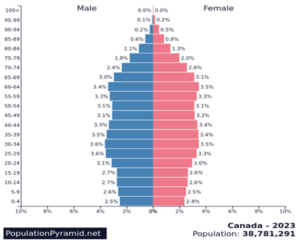

The doubling in Canada’s population over a period of 56 years is pretty modest, amounting to about 1.25% per year, compounded. Much of that growth came from the “baby boom echo”, when the baby boomers born in the immediate post world war period, had kids themselves in the period from about 1980 to 2000. The “echo” generation is now between 25 and 40, and it is easy to see the bulge in the population pyramid that marks their arrival. The largest population cohort is between 30 and 40 years old and they account for 14% of the population. The population under 10 years old is 10% of the population, almost 30% fewer; and the bottom of the pyramid keeps getting narrower.

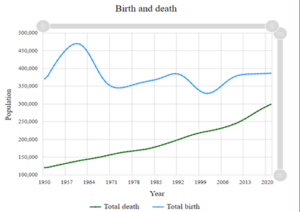

The other part of the growth in population came from immigration, and it is this part of the story that I am writing about today. Most of you will have read the news that in the past twelve or so months Canada has welcomed almost 500,000 immigrants, our biggest annual intake ever. That number absolutely dwarfs the “natural increase”, that is, the difference between births and deaths that occurred in Canada in the same period. That amount was fewer than 100,000 net new Canadians in 2022, a number that has been steadily shrinking as Canadian women have fewer babies, and as our aging population increasingly meets the fate that, eventually, awaits us all.

Canada Births and Deaths from 1950 to 1970

It is evident that, absent immigration, we would soon have more deaths than births each year, leading to a decline in population. This is occurring in a number of countries around the world, chiefly in northern and eastern Europe, but also prominently in Japan, and quite soon, in China. Some countries are projected to see their populations decline by 20% or more in the next 25 years or so.

There is little question that economic growth is highly correlated with population growth, and for obvious reasons. More people require more goods and services. They produce more goods and services and of course, save money and build capital over time. Here are four reasons why we believe that Canada’s current immigration policies are good for the economy and good for the country as a whole.

- Our socialized health care system is a “pay as you go” operation. There is no accumulated store of wealth to pay for future costs, as is the case for example with the Canada Pension Plan. Today’s population pays for today’s health care. The problem is that old people require more health care. According to the Canadian Institute for Health Information, the average annual per person spending in Canada is $2,700 for those aged 64 and below, but more than $12,000 per year for those older than that. Our aging population will require more and more health care, and absent immigration, this will need to be paid for by fewer and fewer people. If we allow a significant number of people under 40 to immigrate, they will help shoulder that burden.

- Canada is under-populated by almost any measure. There are as many people in the Tokyo metropolitan area, about 5,000 square miles (less than ¼ the size of Nova Scotia), as there are in all of Canada, which has 3.9 million square miles. Seoul, South Korea has a population of about 26 million in about 4,000 square miles. Dense populations are easier to serve than widely scattered ones. Urban infrastructure is much cheaper to provide on a per-capita basis in dense cities. Anyone who has taken a train or subway in Japan or South Korea has seen what can be done when there are very large populations to support services. The same is true for communications, healthcare, education and other core public goods. High density encourages greater competition in all areas, leading to lower prices, a fact recognized by Adam Smith over 250 years ago. He noted that an increased number of bakers and coffee shops in an area will lead to better service and better prices. Canada would benefit from enhanced competition in almost every industry and sector.

- Canada is being smart in how it allows immigration. It is mostly selecting youngish, educated people entering their prime working years. We are reaping the often very expensive educational efforts of countries like the U.S. which trains engineers, computer scientists and technologists, but then refuses these highly educated and desirable people permanent residence. We are getting huge amounts of human capital for free; it will pay enormous dividends over decades to come. We are also using selective immigration to meet shortages of skilled workers in key areas such as nursing, building trades and agriculture.

- Canada is currently experiencing record high levels of employment and near record low levels of unemployment. Bringing new younger entrants into the labour force ameliorates upward wage pressure, and thus works to reduce inflation. A larger working population beefs up social safety net programs such as Employment Insurance and workers’ safety compensation schemes. It increases income tax payments and makes the economy more stable.

The American commentator and author Matt Yglesias recently wrote a book “One Billion Americans: The Case for Thinking Bigger”. It argues that for the United States to keep its primacy in the world, it must somehow rival the huge population centres in Asia, and must reset its demographic baselines. It can only do so by way of massive and sustained immigration, as well as policy changes favouring larger families. The book is provocative and in today’s political climate in the United States has mostly been of academic interest. Canada, however, is listening, moving steadily towards one hundred million Canadians. It is a good news story.

Happy Canada Day to all of our clients and friends.

SUMMER RECESSION GOES MISSING – ECONOMISTS BAFFLED

Economics has been called “the dismal science” for the last 200 or so years, and the sobriquet is well-earned. Certainly in the last year or so there has been no end of forecasts for a recession, a stock market crash, mass defaults on mortgages and other loans, and all manner of plagues and catastrophes, lacking only the Biblical ones such as hail, lice, frogs and slaying of the first born. The reasons for all this doom and gloom range from the prosaic (nobody gets a newspaper headline for saying everything is just fine, thanks) to the esoteric (the inverted yield curve; the fall in the Baltic Dry Index; the ratio of consumer debt to income; the small number of companies accounting for the rise in the stock market). Not surprisingly, many of our clients have read the news, and have been to one extent or another, spooked. Inconveniently for the forecasters of doom, the economy in North America appears to be doing fine, and the stock market had a great first half. What’s going on?

It is our view, and we have been singing this song for the last six months, that it is hard to have a recession when there is full employment, and in fact, a shortage of workers. Following the brief but very deep COVID recession, the unemployment rate in the U.S. is back down below 4%, a post-second world war low. Canada’s employment situation is similar. Moreover, average wages have been rising steadily, particularly for lower skilled workers. People are earning money, and they are spending it. It is true that there is an awful lot of consumer debt outstanding, and there is no doubt that the very fast rise in interest rates this year has caused distress for many. But we are not seeing significant defaults on mortgages or credit card debt, at least not so far. Banks have worked with stressed homeowners to manage the higher mortgage costs quite successfully. During the 2008/09 Great Financial Crisis, we learned that even in the worst of times, the very great majority of Canadians do not default on their mortgages, and do not lose their homes.

If a recession was imminent we would expect to see a lot of distressed businesses. We do not. In fact the biggest business problem in many sectors is a lack of available labour. The Globe and Mail reported recently that the construction industry in Canada is in need of 80,000 skilled tradespeople to meet existing demand. The same is true in other sectors. Companies that see bad times ahead do not hire new workers.

It was impressive to see the stock market in the US surmount all the gloom and doom and turn in a great first half. The NASDAQ index was up 33% in the first six months of 2023, and is now 6% higher than the level reached before the dismal period that began last summer. The broad S&P 500 Index rose 16.3%, but is still about 7% lower than its all-time high, reached about 18 months ago. The Dow Jones Industrial Index rose a much more subdued 4% in the first half, almost identical to our own TSX Index which was up a rather anemic 3.7%. It is easy to deduce that most of the gains were in the technology stocks that lead the NASDAQ and which make up an increasingly large part of the S&P 500. Here in Canada, we have nothing equivalent to Apple, Tesla, Meta, Microsoft or the new market darling NVIDIA, and that accounts for the relatively poor performance of the TSX.

Finally, we would note that the earnings reports we saw for the first quarter of 2023 were generally quite good. Earnings drive stock prices, and we will of course be watching with great interest the reports for the second quarter; these will start being announced in about two weeks.

Our advice to our clients: ignore the prophecies of doom. Enjoy your summer.

Chairman

David Baskin

Blog

Understanding the Baskin Fixed Income Pool – David Baskin – June 30, 2023

An Ernest Opinion by Ernest Wong

How Patrick Doyle Can Fix Restaurant Brands – June 20th, 2023

Long Term Investing Podcast with Barry Schwartz

Interesting Reads